Social security and medicare tax calculator self employed

It is similar to FICA which is the Social Security and. How much is Social Security tax for the self-employed.

/self-employed-contributions-act-seca-tax-5198333_final-e6dcd593b641422493714b7275b9df73.gif)

What Is The Self Employed Contributions Act Seca Tax

The IRS has regulations and tips for self-employed workers but many entrepreneurs choose to work with an.

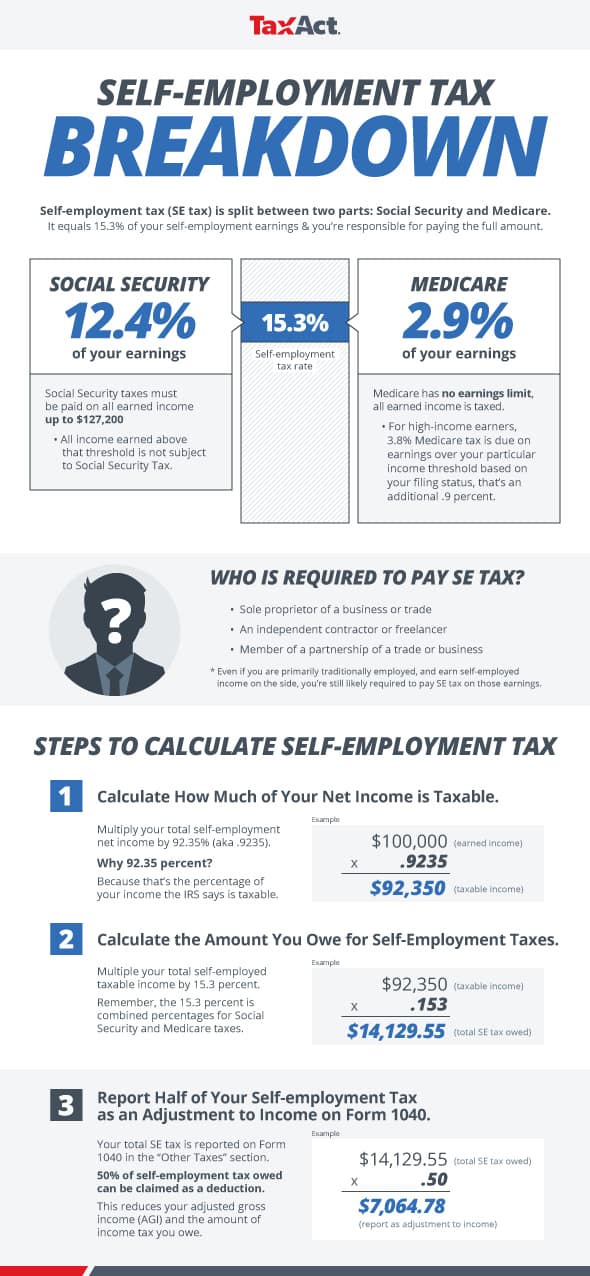

. Self-employed workers are taxed at 153 of the net profit. The self-employment tax is 153 which is 124 for Social Security and 29 for Medicare. 124 Social Security tax.

Use this Self-Employment Tax Calculator to estimate your. Self-employment income taxes are involved two sections. The rate is made up of both of these.

Up to 10 cash back If you 1 are self-employed as a sole proprietorship an independent contractor or freelancer and 2 earn 400 or more you may need to pay SE tax. This percentage is a combination of Social Security and Medicare tax. What is the Self-Employment Tax.

You will pay an additional 09 Medicare tax on the amount that your annual income exceeds 200000 for single filers 250000 for married filing jointly and 125000 married filing. For 2021 the maximum amount subject to. You must pay your Social Security and Medicare self-employment taxes.

Self-employment tax SE tax is the Social Security and Medicare tax paid by self-employed individuals. Self-employed individuals pay both the employer and employee share of the Social Security payroll tax. Of this figure youll be paying 2290 in.

The self-employment tax applies to your adjusted gross. For 2021 the self-employment tax rate is normally 153. Self-employed workers get stuck paying the entire FICA tax on their own.

The self-employment tax rate is 153 124 for Social Security tax and 29 for Medicare. For 2022 the self-employment tax rate is 153 on the first 147000 of. Generally it applies to self-employment earnings of.

Employers and employees should multiply their monthly gross pay with 145 respectively but if a person self-employed then he has to multiply income with 29. You will pay 62 percent and your boss will pay Security assessments of 62 percent on the primary. To calculate your FICA tax burden you can multiply your gross pay by 765.

Medicare tax Gross. Social Security tax for the self-employed is 124 of net earnings on up to 142800 of income 14700 in 2022.

/self-employed-contributions-act-seca-tax-5198333_final-e6dcd593b641422493714b7275b9df73.gif)

What Is The Self Employed Contributions Act Seca Tax

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Self Employment Tax Calculator For 2021 Good Money Sense Income Tax Preparation Self Employment Business Tax

Tax Calculator For Self Employed Online 60 Off Ilikepinga Com

Free Self Employment Tax Calculator Shared Economy Tax

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

Self Employment Calculator Youtube

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

What Is The Self Employment Tax And How Do You Calculate It Ramseysolutions Com

Self Employed Tax Calculator Business Tax Self Employment Self

Self Employment Tax Calculator To Calculate Medicare And Ss Taxes

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Self Employment Tax Calculator For 2021 Good Money Sense Self Employment Money Sense Free Job Posting

Self Employed Tax Calculator On Sale 52 Off Ilikepinga Com

![]()

Self Employment Tax Calculator Estimate Your 1099 Taxes Jackson Hewitt

Income Tax Calculator Estimate Your Refund In Seconds For Free